Experts cite the data points they are following and what the patterns are predicting for 2022

Have you heard of the Five Cs of Aviation? When an aircraft is lost, pilots are trained to do five things: Circle (so they don’t get farther off course), Confess (admit that they are lost and in need of assistance), Climb (to improve visibility), Conserve (determine how far your resources can be stretched), Communicate (use all channels available) and Comply (quickly).

Captains of event journeys may be doubting their courses after the bumpy ride encountered over the last 20 months. In an attempt to set some guiding lights for what is coming next, we checked in with meetings industry air traffic control experts to learn the indicators they look at to determine what turbulence still awaits and where calmer skies may be located. From confidence surveys, vaccination rates and TSA traffic to RFP volume, hiring practices and tech jargon, all signs are pointing to a rapid return to travel—with leisure leading the way and some improvements in the experience along the way. We even looked at the guiderails for diversity, equity and inclusion advances and found some promising signs.

As former Food and Drug Administration Commissioner Scott Gottlieb explained in early December last year, 2022 will be a transition year. “I expect Covid-19 to go from a pandemic into a more endemic phase,” he said on CNBC.

Let’s see what our experts say that means for the trajectory of the meetings world.

Momentum Building

Margaret leads development of GBT’s hotel value proposition and content strategy. She has extensive experience in senior leadership roles in the hotel and travel management sectors, including more than 18 years at HRG.

2022 will be about building on the momentum we started to see in 2021 as we learn to live with Covid and continue to shift from pandemic to endemic. Many of the changes that were put in place in the hotel industry during the pandemic are expected to stay for the future. This is the new normal. Professionals will lean into lessons learned during the pandemic to improve the value, effectiveness and sustainability of future events.

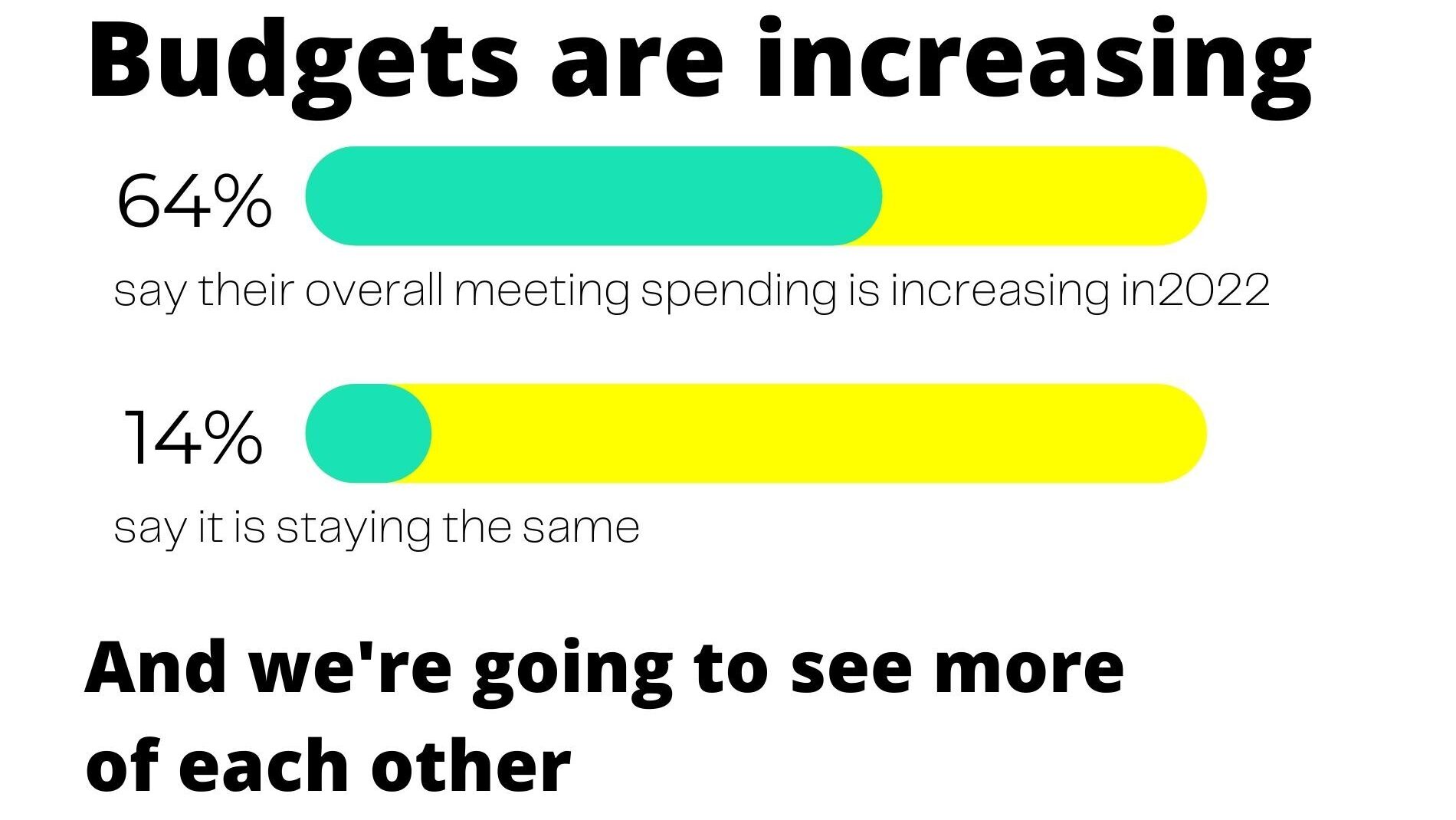

Four trends will continue to shape hospitality in 2022 and beyond: safety and wellness, sustainability, embracing tech and flexibility. This is backed by what we’re already seeing across the industry and insights from our 2022 Global Meetings and Events Forecast, which surveyed 500 meetings and events professionals.

Safety and Wellness

Duty of care will continue to be a priority. Hotel suppliers must have strong risk-mitigation and contingency plans in place, as well as flexible contract terms and cancellation policies in case of changing pandemic restrictions or natural disasters. The safety component of traveler wellbeing will remain important for the hotel industry, as travelers will continue to want to feel safe and comfortable with biosafety standards and physical distancing practices. Our Forecast revealed that the top factor influencing meeting location selection is size of meeting space to accommodate distancing (35 percent).

Sustainability

There’s an accelerated demand to prioritize carbon-conscious programs. Four out of five (83 percent) organizations take sustainability into account when planning meetings and events, and survey respondents say that most meeting policies now include sustainability requirements. In some cases, hotel chains are participating in carbon-neutral or net-zero programs, but in many cases, they are self-monitoring. Other measures may include minimizing water usage, reducing food wastage and food miles—and single-use plastics—as well as offering eco-friendly menus and low-impact food types, and using ethical, local producers. Green certification for hotels and meeting spaces can drive meaningful results for clients and hotels and boost revenue.

Embracing tech

Digital transformation of the travel experience will continue. Contactless payment and check-in have changed travelers’ expectations—people don’t want to wait in line any more to check in for keys or cards. Digitalization will drive differentiation and incremental benefits to organizations that embrace and implement it, increasing satisfaction to travelers and revenues to hotels.

Chains are also investing in and implementing more robust technology solutions, increasing bandwidth and in-house expertise, and in some cases even providing studio spaces for on-site production for hybrid events. “Ability to host hybrid meetings (e.g., Wi-Fi bandwidth, skilled A/V staff)” was cited by M&E professionals as a key factor when selecting a meeting location. Hybrid meetings are great—but they only work well at hotels that have the set-up and bandwidth to manage an engaging virtual environment.

Flexibility

We continue to see great appetite for meeting in-person, but event planners and suppliers need to be nimble and prepared to accommodate location changes in a fast-changing environment for travel and meetings.

This doesn’t just apply to meetings happening internationally—this includes the United States too as we see certain states bring in stricter regulations than others. Lessons learned over the course of the pandemic have already helped the industry prepare and become more agile and flexible.

Regained Optimism and Enthusiasm

Chris oversees MMGY Global’s travel insights and strategy division. He is responsible for the agency’s portfolio of syndicated and custom research products, including its Portrait of American Travelers series and its DK Shifflet suite of travel performance products.

As we approach the end of another highly unusual year, we are truly amazed at the extent to which the domestic leisure travel segment has recovered from the Covid-19 pandemic. Certainly, we are not out of the woods yet, especially in light of news of the new Omicron variant. However, it is clear travelers have regained their optimism and enthusiasm for leisure travel even as health risks remain.

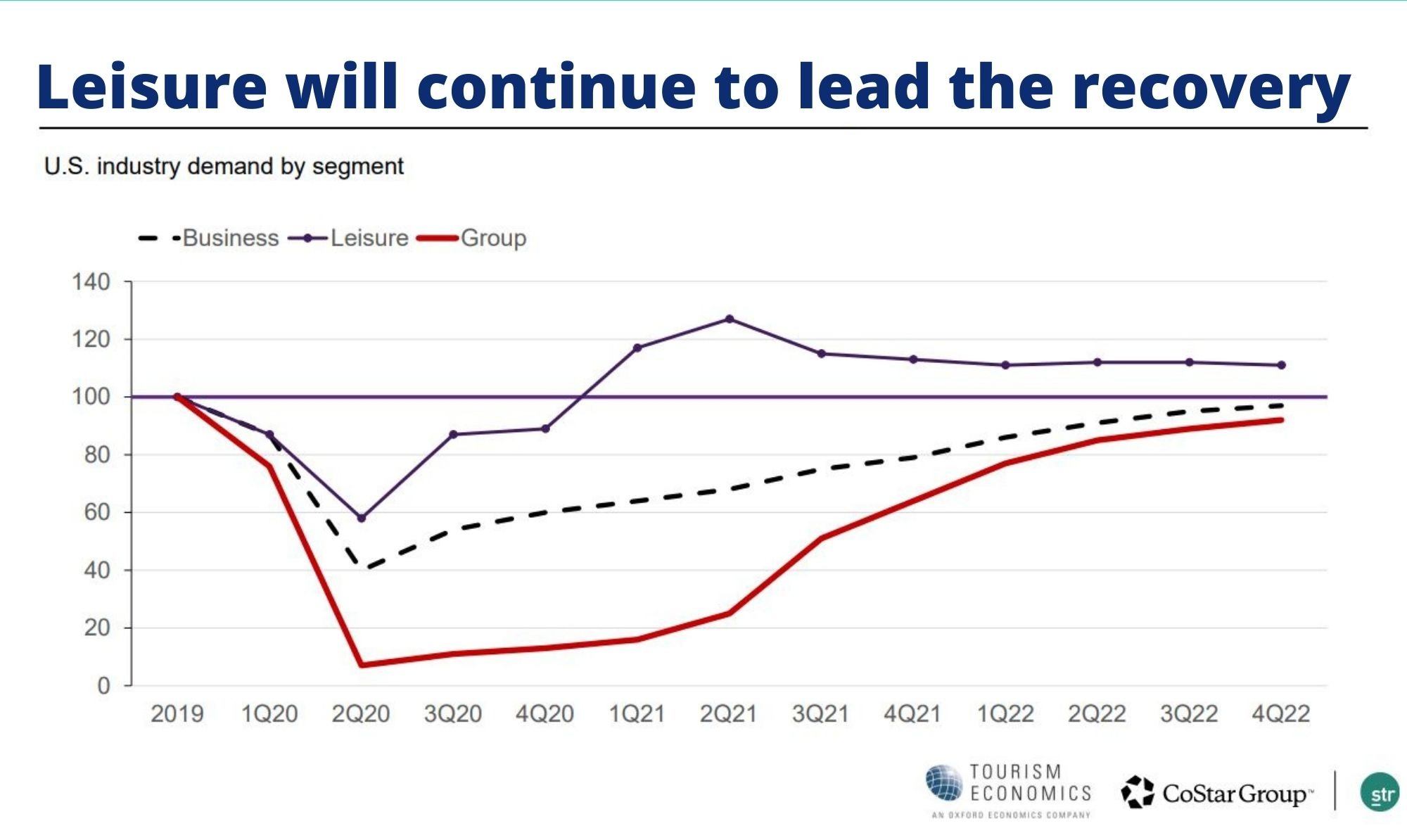

At the same time, the slope of the recovery curve for the corporate/business travel and group/convention travel segments remains much flatter than that of the leisure segment and we do not expect a full return to pre-Covid levels for either of those segments for at least a couple of years.

Still, the news on the leisure front is a source of great optimism as we enter the new year. Americans’ passion for travel remains strong as evidenced by the fact that winter leisure travel intentions remained on par with those expressed in the fall even as perceptions of travel safety declined in response to the rise of the Delta variant. By most accounts, holiday travel is already back in line with pre-Covid levels, and the airlines are doing their best to add flights back to meet the surging demand.

There is good news to report on the vaccine front. 65 percent of active leisure travelers now report they have received their Covid-19 vaccine vs. just 16 percent of leisure travelers who tell us they do not plan to get the vaccine. Pressure is likely to build for remaining vaccine holdouts to get their shots as vaccination requirements become more common. And we do expect this will happen based on what we’re seeing in the data. Almost 6 in 10 (58 percent) of all active leisure travelers say they would be more likely to vacation at a hotel or resort if these properties required vaccinations for all guests and for hotel/resort employees. On the meeting front, 64 percent of travelers say they would be more likely to attend a business meeting, conference or convention if vaccinations were required. As requirements like this become more the norm in 2022, we expect a more tangible recovery for the group segment, especially, to match what we’ve observed in the leisure segment.

As we look to 2022, we expect continued strength and increased pricing power in the leisure travel segment. As travelers increasingly accept health risks as manageable due in part to rising vaccination rates, we expect we’ll see growth in vacation length-of-stay (LOS) metrics, travel further from home, and a higher proportion of “major vacations” in lieu of more frequent local getaways, particularly from the affluent traveler audience. At the same time, overall segment growth may be somewhat tempered by rising consumer travel prices, limited availability in high-demand destinations, and operational challenges caused by a tight hospitality labor market.

F2F Changed Forever

Beau is an industry veteran with over 20 years of experience in designing, delivering, and managing meeting solutions, incentive programs and virtual events. He is responsible for leading CWT’s strategic vision of business development, ensuring that innovative ideas meet client needs now and in the future. He also plays an active role in industry round tables and advisory boards for several leading hotel chains and currently sits on the Digital Task Force for SITE, the Society for Incentive Travel Excellence.

Anecdotal information like TSA travel numbers, vaccination status by geography and tourism output has been helpful in providing a glimpse of the path to recovery for meetings and events. However, these numbers really showcase a picture of leisure travel and tourism recovery and provide less of a leading indicator for meetings and events.

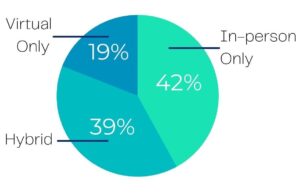

The best data and indicators have come from our global client base. We are able to look at shifting preferences from virtual, to hybrid and a return to live events. We are viewing venue sourcing inquiries by month and looking at volumes in comparison to pre-pandemic levels. In addition, through bookings, cancellations and conversations, we are measuring their confidence in the return to live events. The positive news is that the immediate future; looking into Q2 of 2022 and beyond shows a strong return to a level of events more consistent with numbers in 2019. The reality, however, is that with each new waive or variant, the path to recovery still proves to be volatile.

Our customers are keen to travel and meet face-to-face again. However, safety and security remains the top priority, and so organizations are taking a cautious approach in re-starting travel. We are seeing encouraging domestic travel resuming in several regions worldwide. International travel is a little trickier and is taking longer to restart.

In our customer polls earlier this year 91 percent said they expect to restart large in-person meetings by the end of 2022 and 17 percent of customers said they expect to restart them in 2021 (sales conferences, company leadership meetings, and/or global events).

I would suggest that the percentage of population vaccinated has had a direct correlation with the speed in which individual countries are returning to travel and live events. In addition, government policy and ease of travel is also driving or limiting the return of events. To that extent, markets like the United States have seen a quicker recovery than those in Latin America comparatively. A larger driver or indicator than geography has been the business vertical. As an example, technology organizations have been the most restrictive and outspoken as it relates to cancellation of in-person events, and direct sales organizations, followed by life sciences have been the quickest to return to live events.

Face to face meetings are likely changed forever in response to the pandemic and in a way that is largely positive. A renewed focus on wellness for attendees, sustainability of the event, impact to local communities and a tighter focus on the content or business objective of the meeting appear to be key themes as we emerge from the pandemic.

Certainly, in the short term we are introducing health and safety measures into live events that include pre-arrival health screenings, proof of vaccination status, mask requirements, daily health checks or questionnaires, contact tracing and post event testing with attendee follow up. In addition, live events have been reimagined to account for social distancing and for accommodation of attendees who all have differing levels of comfort with travel and social interaction.

Driven by Leisure

Jan is a member of the Urban Land Institute Hotel Development Council and the AHLA Hotel Investment Roundtable. Prior to joining STR, he was director of content integrity at hotelreports.com in upstate New York and a hospitality consultant with Ernst & Young in Phoenix.

Recovery is being driven by the American leisure consumer. We have seen very limited business and group travel, but weekends have been very good, particularly at beach and mountain properties. That has resulted in high prices. Midweek, business travelers tend to be people who are working with their hands, construction crews for instance. Knowledge workers haven’t completely come back and predictions of when that will happen get a different answer every week because of changes in news headlines, such as the variant.

One hard data point worth watching to determine business travel is TSA traffic Tuesday through Wednesday, which has been trending well. Vaccination rates are another statistic we look at, because even with the Omicron variant, vaccinations can ensure fewer people get really sick.

The other number that is hard to track is people back in the office. Data from Kastle office entry pads indicated that the occupancy of offices in top markets is around 30 percent. That is a crucial indicator for when meetings will return.

The return to meetings will depend on the type of meeting (variations on internal, external, large, small). If a project kick-off is a few internal people who have worked together a long time, Zoom calls might work. For onboarding new people, being in person is probably more efficient. Large external sales meetings might take the form of a satellite hybrid event. Small external sales calls are happening already. Large external groups are the tricky ones because no one wants to be a superspreader event, but if you have good procedures in place, they are so much more efficient than flying around the country to see that many people over a longer period of time. There is a need for internal meetings that used to happen that used to happen in the office, but we will have to see if they are scheduled formally at venues or occur more informally at coffee shops and shared workspaces.

After an incident (9-11, recession) companies always clamp down on meetings, but things loosen up after about three years, so after 2023 we should be back. Unfortunately brands still aren’t building ballrooms. Most new inventory is limited service because that is most profitable so once we make it through the upheaval, there may be a lack of space.

What is being seen as compression now is largely do to a lack of labor, specifically housekeepers. Some properties take inventory off the market because they can’t service them.

My prediction for 2022 is that room rates will go up, in some instances by a lot. But it will probably not make it to hotel bottom lines as wages will go up at a rate we haven’t seen before because they are competing with Amazon for workers. Groups will be paying more, but may have fewer services (limited hours on restaurant and limited room service). By 2023, we will have a better understanding of what full-service means going forward.

If you have flexibility in location, there will be hotels willing to welcome in urban areas, but if in a coastal area, you may have to pay same rates as leisure travelers.

Advancing Equity, Diversity and Inclusion

From 2016 to 2021, Melissa Cherry served as chief operating officer at Destinations International and was responsible for the development and execution of the overall marketing and communications, information technology, meetings and education strategies. She also led and developed the association’s first equity, diversity and inclusion strategic roadmap released in 2020. In her new executive role at Miles, she leads the development of the organization’s equity, diversity and inclusion consulting practice to serve current and potential clients, in addition to guiding the company’s internal DEI processes and best practices. Prior to joining Destinations International, Cherry was senior vice-president for marketing and cultural tourism at Choose Chicago, positions at Chicago History Museum and Los Angeles Tourism & Convention Board.

With the support of Destinations International’s EDI research sub-committee and the association’s Vice President of Research & Advocacy Andreas Weissenborn, a partnership launched in 2020 led to a collaboration with the National Coalition of Black Meeting Professionals (NCBMP) to build an EDI Assessment tool. The goal is to assess practices and measure progress within destination organizations to establish industry standards and promote accountability. The assessment will focus on 6 core areas: workforce, workplace, vendors, community engagement, accessibility and workforce demographics. With a full platform launch in Spring 2022, the industry will have the capability to achieve continuous improvement across EDI policies and procedures.

Indicators to watch in 2022 will center around internal and external commitments that are not always perceived as being measurable. Those internal commitments center on how organizations are implementing strategies to operationalize EDI within the organizational culture; and externally how organizations are executing strategies in their local hospitality community.

As one of the more weighted questions in the platform, the development or implementation of an EDI strategy will be an area to watch. Top objectives for an EDI strategy that every destination should consider as a standard should include creating a culture of inclusion, enhancing engagement in the community and expanding diversity at all leadership levels.

In 2020, the Destinations International EDI Study on Destination Organizations revealed there was an urgent need and opportunity for self-awareness training and additional educational offerings. Through a partnership with The Ladipo Group, Destinations International launched an EDI Masterclass in 2021, designed for executive leadership around the topics of emotional intelligence, effective communication, microaggressions, unconscious bias and allyship. Over 130 executive leaders enrolled in the series. In 2022, there is an opportunity for those leaders to put into action the gained understanding of one’s self-awareness on topics surrounding EDI, and what influence that will have on decision making and organizational culture. It will be interesting to see how those learned EDI competencies will be applied within destination organizations by ultimately making the commitment to develop organizational EDI strategies that will have impact on internal (staff) and external (local community) stakeholders.

Another one of the more critical practices to watch for, will be the commitment to diversity recruiting and hiring practices. Efforts to remove bias from job descriptions, offering a diverse set of workplace benefits, training on inclusive interviewing practices, utilizing diverse interviewing panels, and working with local and state organizations and educational institutions to recruit diverse and non-traditional candidates will be essential.

And finally, another area of focus in the assessment looks to primary oversight and decision-making authority for EDI initiatives. In 2021, there has already been a trend where dedicated EDI positions have been created and hired. Travel Portland, Visit Sacramento and Experience Columbus, just to name a few, have dedicated roles on their staff for EDI. This distinction of oversight and authority is an important shift to watch and should become an industry standard as we watch how groups shift their organizational structures to meet new demands due to the pandemic.

Action Packed

Sandy is Chief Marketing Officer and co-founder, Allseated/ exVo. based in Netanya, Israel of a company that has its roots in video games and has developed tools to help meeting professionals do 3D site inspections and host multi-dimensional virtual cocktail parties.

As a technology company, people tend to ask us about what we think will be coming in 2022. However, technology does not play a part on its own—when we move forward with ideas, we work on two very important components to join the technology growth. One is, will our customers be able to use it? Can we make it simple? And two, is the market actually ready for something new/different? Once we have these answers, we can then apply the discussions and build the tech around the market to fit.

However, times have changed and the market is shifting at such an incredible speed, we sometimes feel that we cannot catch up with developing for the demand. The demand as we see it for 2022 will be in areas where giants have already made the decision for many—and we, as well as others, will follow. You have heard the words “Metaverse”, “NFTs”, “Blockchain”, “AI”, “AR”, “VR” and many others over the last few months. We have already been very involved in many of these so-called new terms that are just now being talked about more often by more people.

Let’s take the Metaverse for example and what it can do for the meetings industry. If the internet is two-dimensional—text and images on flat screens—think of the Metaverse as three-dimensional and multi-sensory (including touch in small ways). The word “Metaverse” was actually coined in the 1992 novel “Snow Crash”, by Neal Stephenson.

Today, hybrid connects in-person events to the virtual world—which is basically a Metaverse. Why is everyone really making such a big fuss about the word and, more importantly, why are giant brands investing billions and billions of dollars into the Metaverse?

The meetings industry is demanding experiences; we are not interested in creating 2D flat surface—square boxes to broadcast our content and expect our clients to be happy and fulfilled. A paradigm shift has started to happen. When such a large shift in an industry happens, many things ripple, including large companies that think they can do it best and are the only ones that can lead the way. Allseated—and the meeting industry—has be there from the beginning. In 2017, we introduced our “venue on the go” through VR Oculus. In 2018, we continued to connect clients in a Zoom-like fashion with visual collaboration through the venue space. You could set-up, design and showcase a space from your living room. Once 2019 arrived, we had the knowledge and creative talents to bring our technology into an experiential virtual world—a Metaverse! We are continuing to build on this functionality through exVo. Clients will continue to demand more high level experiences with faster video and high quality imagery and we will be bringing Hollywood to everyone that wants an experience!

Bonus Advice

Beau Ballin, global market leader for CWT Meetings & Events, shares the elements to consider when planning for events in 2022 and beyond.

Plan Ahead: The first—and perhaps most important—is to allow plenty of time for planning in advance of the event. With rapidly changing policies around travel, planners have become attuned to last-minute booking and planning with mixed results. The short-term bookings have resulted in higher rates, unfavorable attrition clauses and lack of choice in destination, entertainment, activities and supporting suppliers.

Have a Backup Plan: Those planners who are able to book events with a longer lead time will have the benefit of creating a back-up plan for their live events. With an expectation of continued volatility in the new-year, planners need to have a plan if the event is cancelled or if segments of their travelers are unable to attend. Building the event as a hybrid from the start positions planners well but has significant budget implications. Alternatively, having a virtual event plan in advance will reduce unexpected costs and allow meeting owners to deliver on their business objectives.

Communicate Health, Safety and Security Expectations: Planners also need to focus on clear communication to their attendees in terms of how they are managing safety and security before, during and after their event. Each corporation has their own standards for traveler safety and these should be clear and communicated to attendees well in advance. No one should be surprised by mask or vaccine requirements once they arrive on site.

Keep Sustainability and Social Responsibility Top of Mind: Corporate directives on sustainability, social responsibility and diversity, equity and inclusiveness have seen massive and positive shifts over the past 24 months. Company-sponsored events should be a direct reflection of those policies and the brands they represent. Planners need to think critically about what they are doing different or how they are updating their events to be in touch with both the expectations of their attendees and aligned with company goals.

Creativity and Content is Still King: With budget challenges, health and safety concerns and a focus on digital event technology it will be easy for planners to forget about the business objective or purpose of the event. The most successful planners understand that above all, content and creativity is what captivates attendees and delivers a positive return on their event strategy.